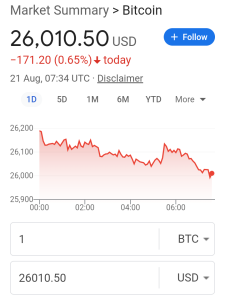

Bitcoin experienced a sharp decline of around 12% this week, dropping below the $26,000 mark. Several factors contributed to this drop, including reduced trading activity, concerns about China’s property market crisis, and news about SpaceX’s sale of some of its bitcoin holdings.

The decrease in trading volumes on exchanges allowed larger trades to impact the price more significantly, resulting in increased price volatility. Glassnode and Coinshares reported a lack of interest in the crypto market, leading to the price decline. Coinshares also pointed out the connection between lower trading volumes and heightened price volatility.

Elon Musk’s involvement added to the uncertainty. Reports emerged that SpaceX had sold a portion of its bitcoin holdings, impacting market perception. Elon Musk’s previous tweets have influenced crypto prices, particularly meme coins like Dogecoin.

Regarding the recent drop, some experts linked it to China’s Evergrande Group filing for bankruptcy. Bitcoin, often likened to “digital gold,” tends to correlate with other risk-on assets during uncertain times, as observed at the beginning of the COVID-19 pandemic. However, Coinshares noted that a potential economic crisis could actually benefit bitcoin.

Despite the challenges, there were positive developments. Coinbase’s approval for offering crypto futures trading in the U.S. was a highlight of the week. Coinshares also mentioned that the market might need to adjust its expectations about the approval of a spot bitcoin ETF, particularly from BlackRock.

Also See:

- Elon Musk Puts an End to Rumors: No ‘X Coin’ in the Works

- Voyager Digital’s Token Transfer to Coinbase Sparks Speculation and Sell-Off Suspicions

In summary, Bitcoin’s 12% drop was influenced by decreased trading activity, concerns about China’s property market, and news of SpaceX’s bitcoin holdings sale. Elon Musk’s influence and the broader economic context played a role, but positive developments like Coinbase’s regulatory approval were also noteworthy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  LEO Token

LEO Token  Dai

Dai  Uniswap

Uniswap  Fetch.ai

Fetch.ai  Pepe

Pepe  Render

Render  Hedera

Hedera  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Wrapped eETH

Wrapped eETH  Mantle

Mantle  dogwifhat

dogwifhat  Immutable

Immutable  Filecoin

Filecoin  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Renzo Restaked ETH

Renzo Restaked ETH  Optimism

Optimism  The Graph

The Graph  Arbitrum

Arbitrum  Arweave

Arweave  Maker

Maker  Monero

Monero  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Sui

Sui  Injective

Injective  FLOKI

FLOKI  Theta Network

Theta Network  THORChain

THORChain  Fantom

Fantom  Rocket Pool ETH

Rocket Pool ETH  Bonk

Bonk  Celestia

Celestia  Lido DAO

Lido DAO  GALA

GALA  Jupiter

Jupiter  Algorand

Algorand  Core

Core  WhiteBIT Coin

WhiteBIT Coin  Mantle Staked Ether

Mantle Staked Ether  Quant

Quant  Sei

Sei  Flow

Flow  Aave

Aave  Akash Network

Akash Network  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  Beam

Beam  SingularityNET

SingularityNET  Worldcoin

Worldcoin  Ondo

Ondo  dYdX

dYdX  Cheelee

Cheelee  Gate

Gate  NEO

NEO  Ethena

Ethena  MultiversX

MultiversX  Chiliz

Chiliz  Zebec Protocol

Zebec Protocol  Ribbon Finance

Ribbon Finance  Axie Infinity

Axie Infinity  Wormhole

Wormhole  The Sandbox

The Sandbox  Tokenize Xchange

Tokenize Xchange  KuCoin

KuCoin  eCash

eCash  Marinade Staked SOL

Marinade Staked SOL  EOS

EOS  JasmyCoin

JasmyCoin